Georgetown title loans offer residents a swift and accessible financial option, leveraging vehicle equity for immediate cash. With minimal requirements—valid ID, proof of ownership, and clear title—lenders assess vehicle value to determine loan amounts. This process provides an alternative for those unable to secure traditional loans. Repayment plans are tailored with budget-friendly payments, making these loans a short-term solution in emergencies, but they carry higher interest rates and potential vehicle repossession risks.

“Georgetown residents often turn to alternative financing options, and one such popular choice is a title loan. This comprehensive guide explores ‘Georgetown Title Loans’ in Texas, offering an insightful look into this secure lending option. We’ll break down the process, from understanding what these loans entail to how they differ from traditional methods. Whether you’re considering a title loan for the first time or seeking more knowledge, this article will highlight the benefits and important considerations for those navigating financial needs within the Georgetown community.”

- Understanding Georgetown Title Loans: A Comprehensive Overview

- How Do Title Loans Work in Texas?

- Benefits and Considerations for Georgetown Residents

Understanding Georgetown Title Loans: A Comprehensive Overview

Georgetown title loans have emerged as a popular financial solution for residents facing cash flow issues or seeking quick funds. This innovative lending option allows borrowers to use their vehicle’s equity as collateral, providing them with access to immediate funds. It’s not just about convenience; it’s also a strategic move for those looking to maintain control over their vehicle while securing a loan.

The Title Loan Process is straightforward and often involves fewer steps compared to traditional loan applications. To qualify for a Georgetown title loan, borrowers typically need to present valid identification, prove Vehicle Ownership, and have a clear vehicle title in their name. Lenders assess the value of the vehicle, considering factors like its make, model, age, and condition, to determine the maximum loan amount available. This process offers an alternative financing option for individuals who may not qualify for conventional loans or are looking for faster access to cash without extensive paperwork.

How Do Title Loans Work in Texas?

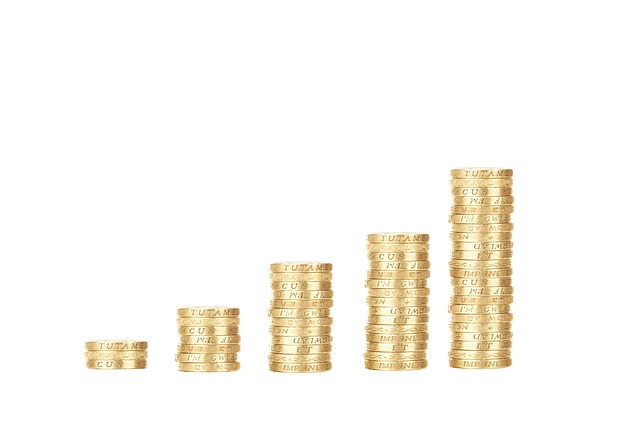

In Texas, Georgetown title loans operate on a simple yet powerful principle: leveraging the value of your vehicle ownership to provide quick cash. Here’s how it works. You begin by applying for a loan, providing your vehicle as collateral. The lender assesses the current market value of your vehicle through its vehicle valuation process, ensuring that the loan amount aligns with a fair and reasonable percentage of that value. Once approved, you receive your funds, while your vehicle remains in your possession. Repayment is structured over a set period, typically with regular payments tailored to fit your budget. This transparent approach makes Georgetown title loans an attractive option for those seeking San Antonio loans without the complexity of traditional loan processes.

Benefits and Considerations for Georgetown Residents

Georgetown residents can benefit from a unique financial solution with Georgetown title loans. This type of secured loan uses the value of an individual’s vehicle—such as cars, trucks, or motorcycles—as collateral, providing access to cash in as little as 30 minutes. It’s an attractive option for those seeking quick funding without the strict credit requirements often associated with traditional bank loans.

When considering Georgetown title loans, it’s essential to weigh the advantages against potential drawbacks. While they offer speed and flexibility, there are risks involved. Interest rates can be higher than conventional loans, and if you fail to repay, you risk losing your vehicle. However, for those in need of fast cash for emergencies or unexpected expenses, San Antonio Loans like these could be a viable short-term solution, bridging the gap until more stable financial arrangements are in place.

Georgetown title loans can offer a unique solution for residents facing financial challenges. By understanding how these loans work and considering their benefits, you can make an informed decision. This comprehensive guide has provided insights into the process, advantages, and potential drawbacks, ensuring that you are equipped to navigate the world of Georgetown title loans with confidence.