Georgetown title loans offer swift financial aid secured by a borrower's vehicle, with online applications, flexible repayment plans (12-36 months), and same-day funding available. No credit checks, early repayment penalties, or needing to give up the car during repayment. Ideal for emergencies, medical bills, or truck loans, these loans provide accessible, manageable financial solutions.

“In times of financial crisis, access to quick and reliable emergency help can be a lifeline. Georgetown title loans offer a unique solution for those in need, providing immediate funding secured by the value of their vehicles. This comprehensive guide explores how these loans work, their numerous benefits, and the step-by-step process of accessing and repaying them. Whether it’s unexpected medical bills or a sudden car repair, understand the power of Georgetown title loans as a viable option for short-term financial support.”

- Understanding Georgetown Title Loans: How They Work

- Benefits and Uses of Emergency Help Through Title Loans

- Accessing and Repaying Your Georgetown Title Loan

Understanding Georgetown Title Loans: How They Work

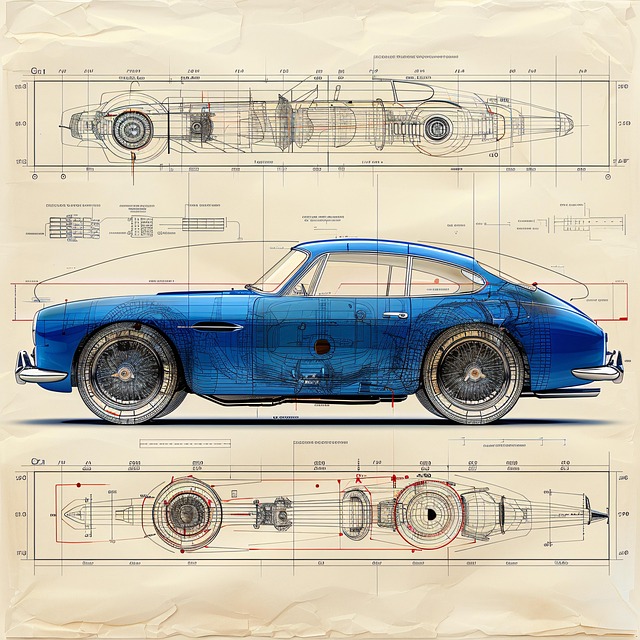

Georgetown title loans offer a unique and efficient way to access financial assistance during emergencies or unexpected expenses. This type of loan is secured by the owner’s interest in their vehicle, providing an alternative to traditional bank loans. The process begins with an online application where borrowers provide details about their vehicle, including its make, model, year, and current mileage. After submitting the form, a lender evaluates the information and determines the loan amount based on the vehicle’s value.

This financial solution is particularly beneficial for those in need of quick cash. Once approved, the lender will issue a check or fund the borrower’s bank account with the agreed-upon loan amount. Repayment terms are structured to align with the borrower’s schedule, often involving weekly or bi-weekly payments. Unlike other loans, Georgetown title loans provide flexibility and allow individuals to retain possession of their vehicle during the repayment period.

Benefits and Uses of Emergency Help Through Title Loans

In times of financial crisis or unexpected emergencies, accessing quick funds is essential for many folks. Georgetown title loans offer a practical solution to bridge this gap and provide much-needed relief. One of its key benefits is accessibility; compared to traditional bank loans, these titles loans have fewer restrictions on eligibility criteria, making them available to a broader range of individuals. This includes those with less-than-perfect credit or limited banking history. The application process is straightforward and often involves the security of your vehicle as collateral, ensuring faster approval times.

The versatility of Georgetown title loans is another advantage. Whether it’s covering urgent medical bills, unexpected home repairs, or even funding a semi-truck loan, these cash advances can be tailored to various needs. Unlike credit cards with high-interest rates, title loans offer a fixed-rate structure, providing borrowers with better financial control and peace of mind. Moreover, repaying a title loan can be more manageable due to the structured repayment plans, allowing individuals to get back on their feet without the added stress of overwhelming debt.

Accessing and Repaying Your Georgetown Title Loan

Accessing your Georgetown title loan is a straightforward process. Once approved, you can receive your funds quickly, often within the same day. The lender will provide clear instructions on how to sign and hand over your vehicle’s title as collateral for the loan. It’s important to have all required documents ready before starting the application.

Repayment terms are flexible, allowing borrowers to pay off their loans in installments over a set period, typically 12-36 months. There are no hidden fees or penalties for paying early. To ensure timely repayment, maintain open lines of communication with your lender and stay on top of scheduled payments. An online application process makes it easy to manage your loan and track repayments from the comfort of your home. Additionally, with no credit check required, more individuals can access this emergency financial aid option without worrying about their credit score.

Georgetown title loans offer a reliable emergency help solution, providing fast access to cash without traditional credit checks. With clear terms and flexible repayment options, this alternative financing method can be a game-changer for those in need. Remember that while convenient, it’s crucial to understand the costs involved and repay according to the agreed terms to maintain a healthy financial standing. Accessing this emergency help is simple, and with responsible borrowing, individuals can navigate challenging situations with confidence.